The Centers for Medicare and Medicaid Services (CMS) has updated the QPP Participation Status Tool for the 2023 performance year. Clinicians can now verify their final 2023 eligibility for the Merit-based Incentive Payment Program (MIPS) by entering their individual National Provider Identifier (NPI) into the tool or checking their MDinteractive account dashboard. Clinicians can also check their eligibility in an Advanced Alternative Payment Model (APM) and preliminary MIPS status for 2024. This blog will guide clinicians through understanding MIPS eligibility and determining their reporting requirements.

Review Your Final 2023 MIPS Eligibility

The QPP Participation Status Tool now shows your final 2023 MIPS eligibility, indicating whether you qualify to report MIPS individually, as part of a group, or both. MIPS eligibility is based on your individual NPI and associated Tax Identification Number(s) (TINs). This means you may need to report MIPS for more than one practice. The CMS tool lists any practice(s) your NPI is associated with and if you have a special status designation, such as hospital-based, non-patient facing, or small practice. It also includes information about your ability to opt-in to MIPS.

Eligibility and special statuses are based on a review of claims and Provider, Enrollment, Chain, and Ownership System (PECOS) data from October 1, 2022 - September 30, 2023. Remember, you need to review your eligibility for each TIN/practice for which you submit Medicare claims. It is important to check both your MIPS and APM participation status.

|

MIPS eligibility can be checked directly from your MDinteractive account. Once you add your NPI and TIN to the homepage dashboard, just click the blue “Check MIPS Eligibility” underneath the clinician's name. Next, select “click for more info” to be taken to the QPP Participation Status website. |

How CMS Determines Your Eligibility

Your MIPS eligibility is determined by:

- Your clinician type

- The volume of care you provide to Medicare patients

- The date you enrolled as a Medicare provider

- The degree to which you participate in an Advanced APM (your Qualifying APM Participant (QP) status)

MIPS Eligible Clinician Types

There are several “types” of providers that are considered “MIPS eligible clinicians” in 2023 and are included in the program if they bill Medicare Part B claims:

- Physicians (including doctors of medicine, osteopathy, dental surgery, dental medicine, podiatric medicine, and optometry)

- Osteopathic practitioners

- Chiropractors

- Physician assistants

- Nurse practitioners

- Clinical nurse specialists

- Certified registered nurse anesthetists

- Physical therapists

- Occupational therapists

- Clinical psychologists

- Qualified speech-language pathologists

- Qualified audiologists

- Registered dietitians or nutrition professionals

- Clinical social workers

- Certified nurse midwives

Are You MIPS Eligible as an Individual?

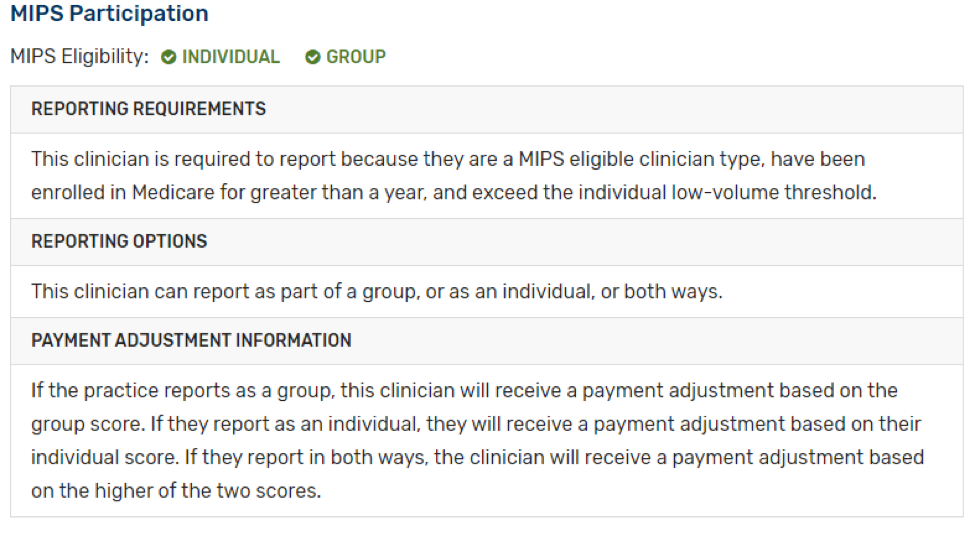

When checking your MIPS participation status, it will show your MIPS eligibility as an individual clinician and as a group. You are MIPS eligible as an individual clinician if you:

- Are identified as a MIPS eligible clinician type on Medicare Part B claims

- Have enrolled as a Medicare provider before 2023

- Are not a Qualifying Alternative Payment Model Participant (QP); and

- Exceed the low-volume threshold as an individual as outlined in the table below:

| Low Volume Threshold Criteria | ||

|

Bill more than $90,000 in Medicare Part B covered professional services; AND |

See more than 200 Medicare Part B patients; AND |

Provide more than 200 covered professional services to Medicare Part B patients |

***An individual clinician who is eligible for MIPS must report MIPS data to avoid a negative payment adjustment.

Are You MIPS Eligible as a Group?

CMS evaluates eligible clinicians under each NPI/TIN combination for eligibility against the low-volume threshold at both the individual and group level. If your practice exceeds all three low-volume threshold criteria as a group the practice is eligible for MIPS and can choose whether or not to participate as a group.

In group reporting, the submission must encompass data for all clinicians billing under the same TIN, even those who don't qualify individually. If you're not individually eligible for MIPS but your group is, your data must be included if your practice decides to report MIPS at the group level.

It's important to note that group participation in MIPS is optional, not mandatory. Practices eligible at the group level have the discretion to participate as a group or not. Should your practice choose not to participate in group reporting, clinicians who are exempt from MIPS won't need to report. However, those who are individually eligible will still be required to report MIPS on an individual basis.

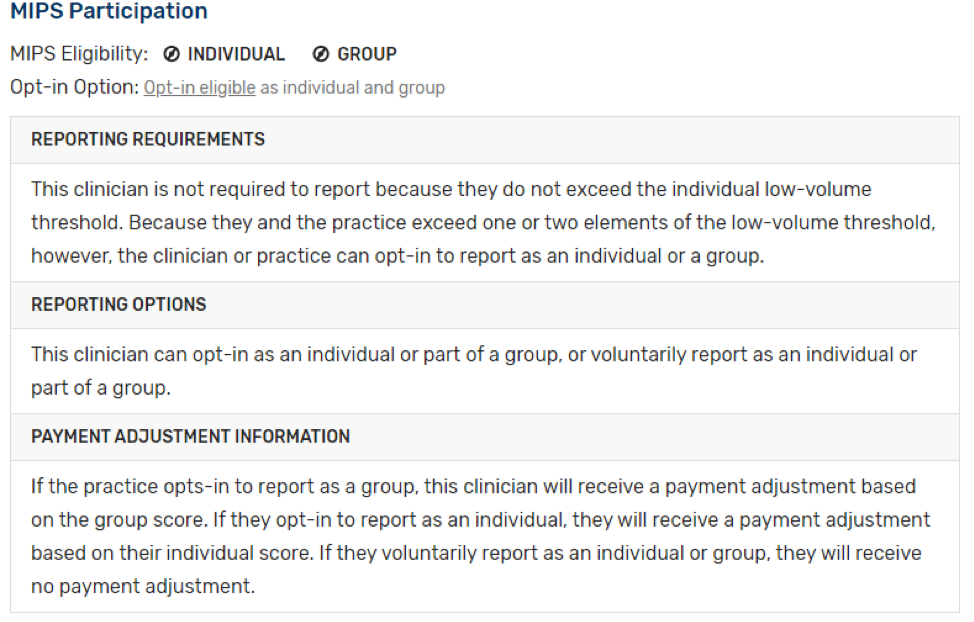

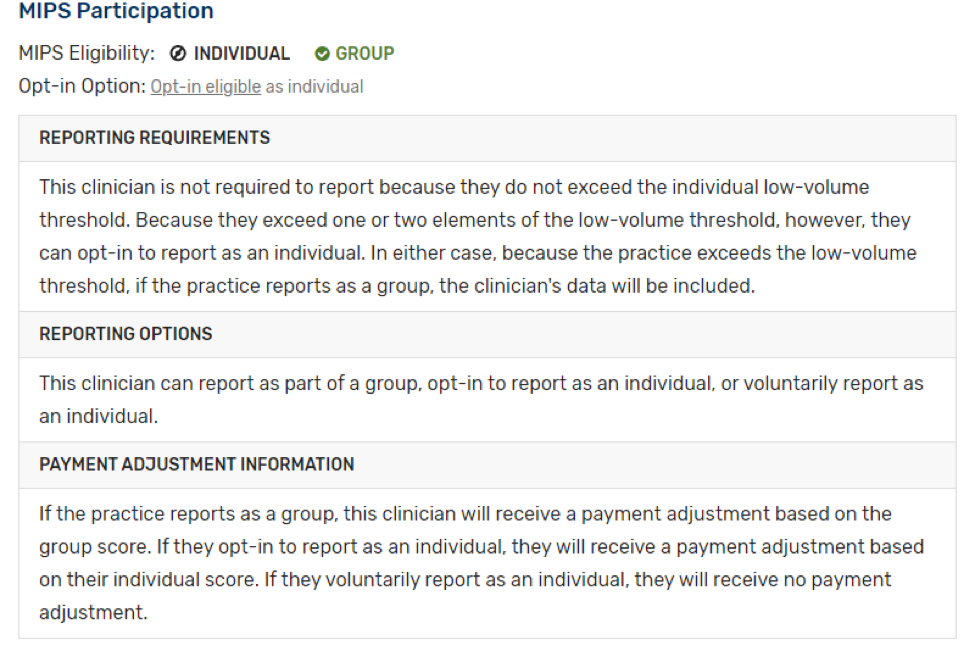

What is the Opt-In Option?

If you or your group is otherwise eligible for MIPS and exceeds one or two, but not all three low-volume threshold criteria, you’re considered “opt-in eligible”. If you’re opt-in eligible, you can:

- Take no action. Since you do not meet the full low-volume threshold, there is no obligation for you to participate in MIPS.

- Choose to opt-in. This option is applicable only for traditional MIPS and the APM Performance Pathway (APP). Opt-in eligible clinicians are not permitted to report a MIPS Values Pathway (MVP). Opting in involves submitting data, receiving feedback on your performance, and being subject to a MIPS payment adjustment in 2025.

- Choose to voluntarily report (traditional MIPS only.) If you don’t want to receive a MIPS payment adjustment in 2025, but want to participate in MIPS, you can voluntarily report data and receive limited performance feedback on the data you report.

Remember, if you “opt-in” to the MIPS program you will be subject to neutral, negative, or positive payment adjustments based on your MIPS performance and final score. Once you elect to “opt-in”, the decision is irreversible for the current performance year.

MIPS Determination Period

CMS reviews your Medicare Part B claims and PECOS data from two 12-month periods to determine the volume of care you provide to Medicare beneficiaries:

| Review Period |

Posted on QPP Status Tool |

|

October 1, 2021 - September 30, 2022 |

Initial eligibility was released in December 2022 |

|

October 1, 2022 - September 30, 2023 |

Final eligibility was released in November 2023 |

You must exceed all three of the low-volume threshold criteria during both parts of the MIPS determination period to be included in MIPS. Your eligibility could change during the second period for reasons such as joining or leaving a practice, so it is important to check your final status again. However, if you are not MIPS eligible for your existing practice during the first review period, you won’t become MIPS eligible for that same practice during the second review period.

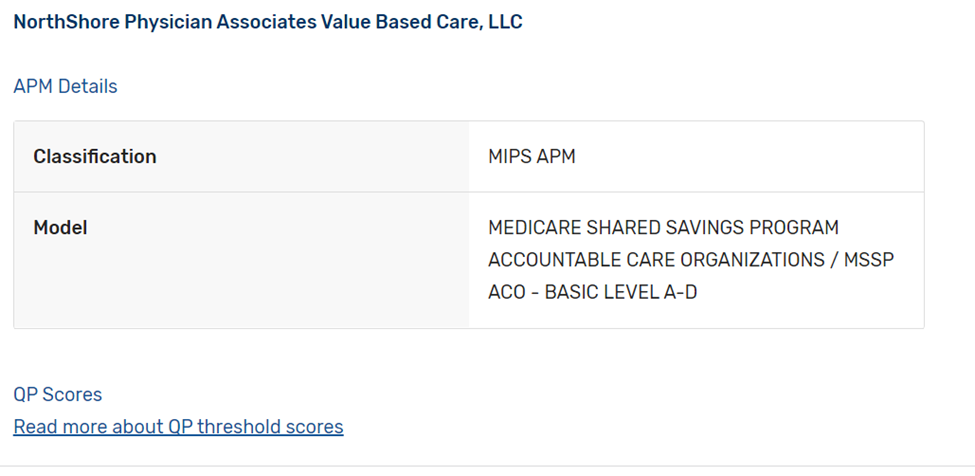

APMs

The QPP Participation Status Tool will also indicate if you participate in an APM. An APM is a payment approach that gives added incentives to provide high-quality and cost-efficient care. APMs can be designated as MIPS APMs or Advanced APMs. MIPS APMs participate in the APM under an agreement with CMS. Eligible clinicians in a MIPS APM will receive MIPS payment adjustments and MIPS-APM specific rewards.

On December 8, the QPP Participation Status Tool was updated based on the third snapshot of APM data. The third snapshot includes data from Medicare Part B claims with dates of service between January 1, 2023, and August 31, 2023. The tool includes the 2023 Qualifying APM Participant (QP) status and MIPS APM participants may report MIPS via the APM Performance Pathway (APP). MIPS eligible clinicians participating in Advanced APMs will be required to participate in MIPS unless they earn QP or Partial QP status or are otherwise exempt.

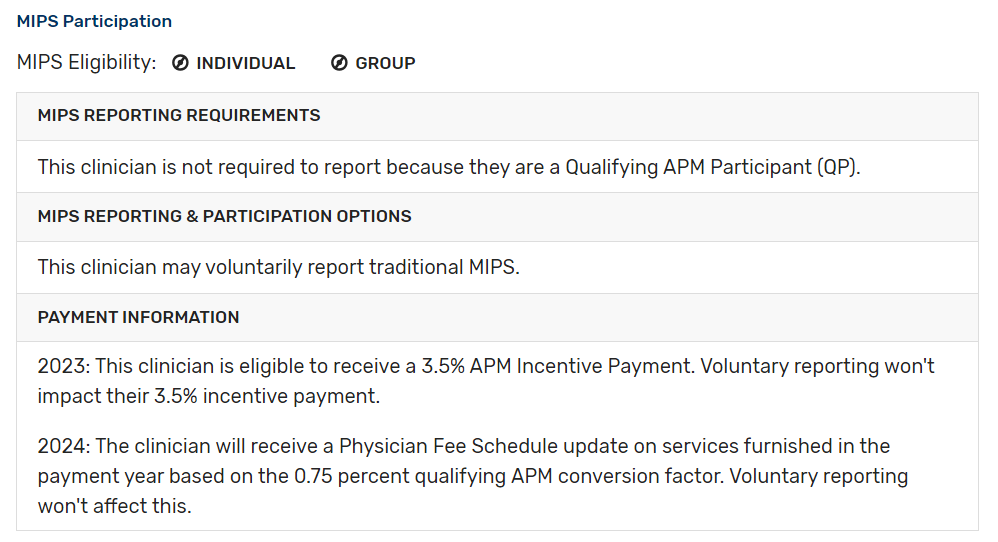

What is a QP?

If you qualify as a QP, this means you are:

- Eligible for the 3.5% APM incentive payment;

- Eligible for APM-specific rewards; and

- Exempt from participating in MIPS.

If you’re identified as a partial QP, you may opt-in to MIPS.

APM Determination Period

CMS reviews APM participation throughout the performance year. During each review period, CMS will determine if you are a Medicare Qualifying APM Participant (QP) or Partial QP and exempt from MIPS reporting.

|

APM Snapshot |

Posted on QPP Status Tool |

|

January 1, 2023 – March 31, 2023 |

July 2023 |

|

January 1, 2023 – June 31, 2023 |

October 2023 |

|

January 1, 2023 – August 31, 2023 |

December 2023 |

| January 1, 2023 - December 31, 2023 (MIPS APMs) | March 2024 |

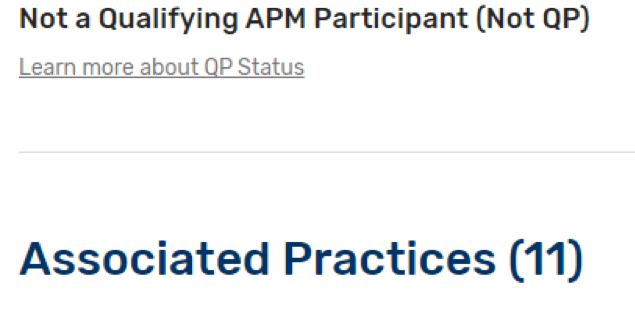

Below are examples of different scenarios that might appear on the QPP tool if you participate in an APM and how each could affect your MIPS eligibility.

- If you participate in an Advanced APM and are a Qualifying APM Participant (QP) or Partial QP you are not required to report MIPS:

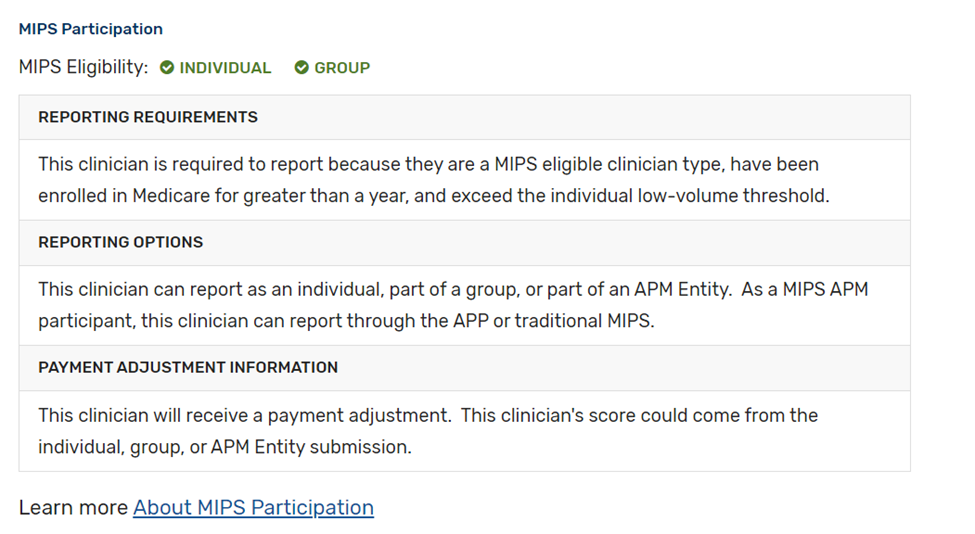

- If you participate in certain types of MIPS APMs (for example Medicare Shared Savings Program ACO – Track 1), the APM entity should submit Quality data on your behalf. You should contact the APM to confirm any reporting requirements:

- If you participate in a MIPS APM, but are considered a “preferred provider”, you may be required to report MIPS unless otherwise exempt:

- If you bill with multiple TINs, your status will be noted for each practice. If you are not a QP, you may be required to report MIPS for one of your practice TINs and required to follow the APM rules for another practice TIN:

Next Steps

CMS updates the QPP Participation Status Tool throughout the performance year. Clinicians can verify if they are required to report MIPS or are part of an APM by entering their NPI into the tool or checking their MDinteractive account dashboard. It is important to check MIPS eligibility and APM status for each TIN/practice listed on the CMS website.

Leave a comment